145 billion, million, trillion nothings

Wednesday, October 8th, 2008 by Michael LabanWell, I do not know about you, but I have almost completely moved outside the Zanu PF economy. Of course, there is no point being in it. I cannot make it work, it does not work for me (nor anyone else it seems), nor does it even work for Zanu PF. And it is like voting. A bit of ‘voting with your feet,’ but I can do it without leaving. I can select the regime I want to be in, and I want to be in one that works.

And it is no longer foreign currency – it is now a local currency for working markets. The US dollar economy is the one that seems to work. You can sell goods and services in it, and buy goods and services in it. Work on a budget. Save. All those things we used to do, before they destroyed our medium of exchange by printing.

From the most basic economy, a barter economy, – you swap this or that you do not need for that which you do. Next step up, the introduction of a ‘medium of exchange’. You can then swap what you do not need for this currency device, and use this currency device to swap for stuff you do need later. The medium of exchange still has enough value, and retains it’s value for long enough, to make the bigger deal (what you did not need, for what you do need) viable after more than five hours. This ‘medium of exchange’, the Zanu PF dollar, is no longer that instrument. However, the USD is – or Rands will work too, or Yuan, Yen, Metcais, Pula, Kwacha, Pounds etc, just the USD we all know. And know it’s value.

So Zanu PF is now trying to control this economy. Despite our ‘sovereignty’. They are licensing US$ shops. (They even tried to license power generators in US$.) And of course they have to control it. The whole point of power, (which they are clinging to tenaciously) is to make money. So what is the point of controlling the counter, when everything happens under the counter? Moreover, a government must live in a budget. It collects revenue, from its citizens (tax) and in exchange provides them with services. The City government collects rates and takes away our refuse and provides roads with no potholes. A national government collects taxes (income, corporate, VAT, etc) and provides security (cross border – the ZNA, internal, the ZRP), water, education, health, passports etc. However, this local national government has destroyed the economy, therefore they have no tax base, therefore they provide no services.

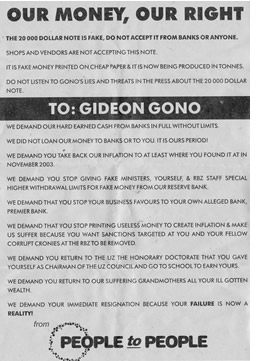

Specifically, they cannot pay the Army. So they do it by printing more money, convincing the soldiers that it is a ‘medium of exchange’, so the guys with guns do not use them against their employers. Simple. However, it cannot last forever. The bubble will burst. The soldiers will realize that they are not really getting paid, but are working as Zanu PF volunteers.

However, for the rest of us (who do not have civil service jobs), the USD economy works. The main problem being cash. (Sounds like the Zanu PF one!) Getting enough cash for day-to-day transactions. Small bills for making change. Etc. But everyone has it. Gardeners and maids are getting paid in it (and very happy to be too). You can buy vegetables from the street vendors with it. Telephone top up cards. Everything you need to buy: meat, drinks, bread, milk, pet food, fuel, dinning out, movies, club subscriptions, books, paintings, etc is done in real money. A real medium of exchange.

You cannot put USD in a bank (for safe keeping) but then the bank is just a black hole anyway. I think I have about three accounts with there different institutions but there is nothing really there. Just Zanu PF money, and the figures are meaningless. 19 trillion times 57 billion at a rate of 63 gadzillion to 100 times nothing is 145 billion, million, trillion nothings.